At Al Wahda, we provide comprehensive VAT consultancy services in Sharjah to help businesses navigate the UAE’s VAT regulations with confidence. Our team ensures you remain fully compliant while maximizing your tax efficiency.

Menu

VAT Consultant in Sharjah

VAT Consultant in Sharjah Expert VAT Solutions for Your Business

Navigating the complexities of VAT compliance in the UAE can be challenging—especially for businesses that want to focus on growth while ensuring they meet every requirement set by the Federal Tax Authority (FTA). At Al Wahda, we provide comprehensive VAT consultancy services in Sharjah tailored to your business’s needs, helping you remain fully compliant, avoid penalties, and optimize your tax position.

Our team of VAT experts brings years of industry experience, in-depth knowledge of UAE VAT law, and a commitment to delivering clear, practical advice. Whether you are a start-up, SME, or large enterprise, we ensure your VAT processes are efficient, transparent, and aligned with legal standards.

Our VAT Services Include

VAT Registration & Deregistration

Whether you are starting a new business or restructuring an existing one, VAT registration is a mandatory step for eligible companies in the UAE. If your business no longer meets the VAT threshold, we also handle deregistration, ensuring you meet all compliance obligations before closing your tax account.

Periodic VAT Return Filing

Filing VAT returns in the UAE is a critical compliance requirement, but it can be challenging for businesses due to the strict deadlines and detailed reporting standards set by the Federal Tax Authority (FTA). At Al Wahda, we take the stress out of this process by managing your VAT return filing from start to finish.

VAT Health Checks & Gap Analysis

Our VAT health check service provides a thorough review of your business’s VAT compliance status. We meticulously examine your financial records, invoices, contracts, and past VAT filings to identify any errors, inconsistencies, or areas where you might be missing out on legitimate VAT recovery opportunities.

VAT Compliance Audits

Staying compliant with VAT regulations is crucial for avoiding costly fines and legal issues. Our VAT compliance audit service is designed to provide an in-depth assessment of your VAT processes, documentation, and reporting standards. We evaluate whether your internal systems meet all FTA requirements, verify the accuracy of your VAT returns.

VAT Planning & Optimization

VAT compliance is just one part of the equation—strategic VAT planning can also improve your cash flow and overall profitability. Our VAT planning and optimization service focuses on structuring your transactions in a tax-efficient way, minimizing unnecessary VAT liabilities, and maximizing recoverable input VAT. We analyze your business model, supply chain, and contracts to design a VAT strategy.

VAT Invoice Format Validation

A properly formatted VAT invoice is essential to ensure compliance with UAE regulations. Any incorrect or missing information could lead to penalties or the rejection of VAT claims. Our team reviews and validates your invoice formats to confirm they include all required details, such as TRN (Tax Registration Number), VAT rates, taxable amounts, and proper descriptions of goods or services.

What Does a VAT Consultant Do?

A VAT consultant is a financial and tax professional who helps businesses navigate the complexities of Value Added Tax in the UAE. Their role extends beyond basic compliance—they act as strategic advisors, ensuring that your business not only meets legal requirements but also operates in a tax-efficient manner. In Sharjah, a VAT consultant’s duties typically include:

- Strategic Location in the UAE

- Fully Furnished & Ready-to-Move-In Offices

- Flexible Options for Every Business Size

Benefits of Hiring a VAT Consultant in Sharjah

Partnering with a professional VAT consultant offers multiple advantages, especially for businesses operating in Sharjah’s competitive market:

- Expert Knowledge of UAE VAT Laws

VAT regulations in the UAE can be complex and are subject to frequent updates. A consultant ensures you stay fully compliant with the latest rules. - Time & Resource Savings

Instead of dedicating internal resources to VAT processes, you can focus on growing your business while your consultant handles compliance efficiently. - Reduced Risk of Penalties

Incorrect VAT filings or missed deadlines can result in hefty fines. A consultant’s expertise helps you avoid costly mistakes. - Optimized Tax Strategies

Beyond compliance, consultants identify ways to recover more VAT, reduce liabilities, and improve overall tax efficiency. - Seamless Audit Support

If the FTA conducts a VAT audit, your consultant can represent your business, prepare documentation, and respond to queries, ensuring a smooth process. - Tailored Advice for Your Industry

A Sharjah-based VAT consultant understands local business practices, industry-specific challenges, and regional regulations, providing targeted solutions.

Why Choose Al Wahda for VAT Services in Sharjah?

Local Expertise

Full-Service Support

Tailored Solutions

Proven Experience

Accuracy & Compliance

Hassle-Free Process

Why Entrepreneurs Choose Al Wahda

We understand that entrepreneurship isn’t just a career path—it’s a mindset. That’s why we work not just as service providers, but as partners in your success.

100% Control Of Your

Business.

End-to-End

Support

Global Market

Access

Transparent

Communication

UAE

Expertise

Customized

Solutions

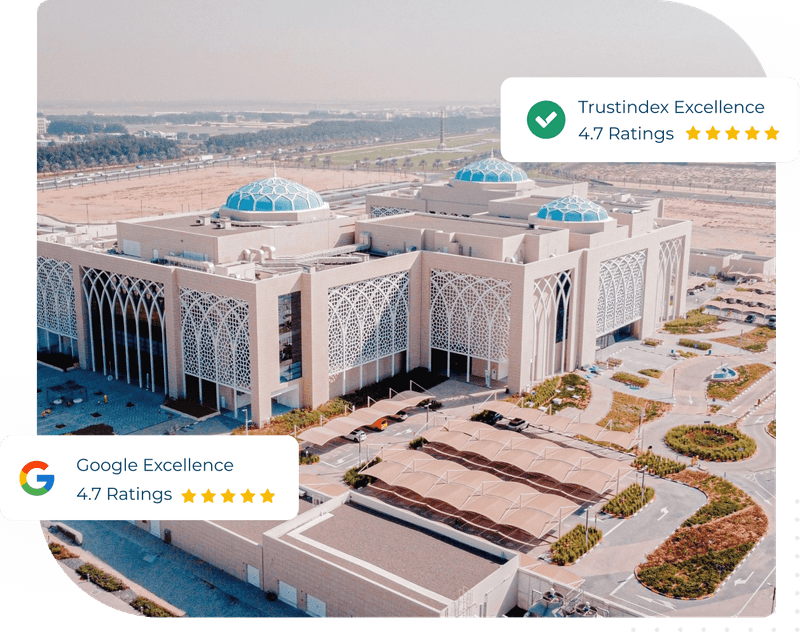

What our

Customers Says

Trustindex verifies that the original source of the review is Google. Trustindex verifies that the original source of the review is Google. Exceptional service and a very professional team! The staff at Al Wahda Business Center are always friendly, helpful, and efficient. The facilities are clean, well-maintained, and perfectly equipped for business needs. Communication is smooth, and everything is handled with great attention to detail. Highly recommended for anyone looking for a reliable and professional business center in the area!Trustindex verifies that the original source of the review is Google. بكل أمانة، أعتبر مركز الوحدة للأعمال أفضل مركز تعاملت معه حتى الآن. يتميّز فريق العمل فيه بالاحترافية العالية والإخلاص في أداء المهام، وقد وجدت لديهم دعماً حقيقياً في كل خطوة من خطوات تأسيس مشروعي. أنصح بشدة كل من يرغب في بدء مشروعه التجاري في دولة الإمارات بأن يختار مركز الوحدة للأعمال، فهو ليس مجرد مركز أعمال، بل شريك موثوق يساعدك ويكون معك في كل خطوةTrustindex verifies that the original source of the review is Google. After working with several other companies, I can confidently say that Al Wahda Business Centre is the best I've experienced. I highly recommend them.Trustindex verifies that the original source of the review is Google. Very professional and peaceful atmosphere with all the necessities of an well established office.Trustindex verifies that the original source of the review is Google. Great service very professional helpful and frendly team .I'm really satisfied with the support they provided. Highly recommend this companyTrustindex verifies that the original source of the review is Google. Exceptional Business Support & Professional Environment Halaldays Tourism has been operating from Al Wahda Business Center since inseption, and we are extremely satisfied with the services and environment they provide. Located in the heart of Sharjah at Rolla – Burj 2000 (Damas Tower), the business center offers a highly strategic and accessible location for our operations. From private office space to reliable reception services and well-equipped meeting rooms, the infrastructure here is ideal for growing businesses like ours. The team at Al Wahda is professional, responsive, and always ready to support with tailored solutions — be it business setup, PRO services, accounting, or legal consultation. The flexibility in workspace options and the presence of value-added services under one roof make this business center a complete solution provider for any company looking to establish or expand in the UAE. Highly recommended for entrepreneurs, startups, and established businesses alike! Nahiyan Najeeb Founder & Director Halaldays Tourism Road to dreams & destinationsTrustindex verifies that the original source of the review is Google. One of the best business center in SharjahTrustindex verifies that the original source of the review is Google. 👍👍👍Trustindex verifies that the original source of the review is Google. Highly recommend them, good people with good work. Thank you Mr.Alam and Mr.Ahmed for the support during the entire registration process of our work space.Google rating score: 5.0 of 5, based on 25 reviews

Frequently Asked Questions

1What does a VAT consultant do?

A VAT consultant provides expert guidance on Value Added Tax laws, registration, filing, and compliance. They help ensure your business follows UAE Federal Tax Authority (FTA) regulations, minimizes tax liabilities, and avoids penalties.

2. Do all businesses in Sharjah need to register for VAT?

If your taxable supplies and imports exceed AED 375,000 in the last 12 months, VAT registration is mandatory. Voluntary registration is also available for businesses above AED 187,500 in turnover.

3How can a VAT health check benefit my business?

A VAT health check reviews your past records, invoices, and filings to spot errors, missed claims, or risks. This helps prevent fines and recover any eligible VAT you might have missed.

4Can Al Wahda help me claim a VAT refund?

Yes. We assist in preparing and submitting VAT refund applications for exporters, international businesses, and eligible service providers to ensure quick FTA approval.

5 What are the penalties for VAT non-compliance in the UAE?

Penalties can include fines starting from AED 1,000 for late filings, incorrect returns, or missing invoice details. Severe non-compliance may lead to higher fines or legal action.

Ready to Strengthen your legal strategy? Let’s connect.

Let’s discuss how we can support your business.

Get in Touch!