Sharjah Free Zone Company Setup

Sharjah Free Zone Company

Your Cost-Effective Gateway to the UAE Market

Setting up a company in a Sharjah Free Zone is an excellent choice for entrepreneurs, startups, and SMEs seeking affordable business solutions with regional and global reach. As one of the fastest-growing Emirates in the UAE, Sharjah offers strategic advantages, robust infrastructure, and simplified business regulations—making it ideal for a wide range of industries including media, manufacturing, trading, logistics, and services.

At Al Wahda, we provide end-to-end consultancy and legal support to streamline your Free Zone setup in Sharjah—from selecting the ideal zone and license type to completing documentation, visa applications, and bank account opening. Whether you are a first-time investor or expanding your existing enterprise, we ensure a seamless and fully compliant business launch.

Benefits of starting a: business in Sharjah

Starting your business in a Sharjah Free Zone offers a strategic advantage for entrepreneurs, startups, and SMEs seeking to establish a presence in the UAE while maintaining cost-efficiency and operational flexibility.

100% Foreign Ownership

With recent reforms, many business activities in Sharjah Free Zones now allow full foreign ownership, giving you complete control over your company.

Strategic Global Location

Sharjah location connects East and West, offering easy access to Asia, Europe, and Africa — ideal for logistics, trade, and exports.

Tax Advantages

Sharjah offers 0% personal income tax and low corporate taxes, enabling better profit retention and growth potential.

World-Class Infrastructure

From high-speed internet and modern offices to efficient logistics and transport, Sharjah provides a cutting-edge business ecosystem.

Access to Global Markets

Sharjah acts as a gateway to over 2 billion consumers across the Middle East, Africa, and South Asia — making it an ideal export and distribution hub.

Networking & Growth Opportunities

Sharjah is home to global expos, business events, and conferences — ideal for forming partnerships and scaling quickly.

Basic Documents Required for Sharjah Free Zone Company Setup

To establish your business in a Sharjah Free Zone, you’ll need to submit essential documentation based on your business structure (individual or corporate).

For Individual Shareholders:

Passport copy of the shareholder(s) and manager

Visa copy or UAE entry stamp (if applicable)

Passport-sized photograph with a white background

Proof of residential address (such as utility bill or bank statement)

No Objection Certificate (NOC) from current sponsor (if holding a valid UAE visa)

For Corporate Shareholders:

Certificate of Incorporation

Memorandum & Articles of Association

Board Resolution authorizing the establishment of a new company in Sharjah

Valid Trade License or Business Registration Certificate

Passport copy of the authorized signatory

Types of Business Licenses in Free Zone

1. Commercial License

Issued to companies involved in trading activities—such as buying and selling goods, general trading, and retail businesses. This is one of the most commonly issued licenses in the UAE.

2. Industrial License

Ideal for businesses engaged in manufacturing, industrial production, or processing of goods. This license allows operations such as factories, assembly lines, and industrial plants.

3. Professional License

Required for individuals or companies offering professional or service-based activities. This includes consultancy firms, IT services, legal advisory, accounting, marketing, and more.

4. Tourism License

For businesses in the travel, hospitality, and tourism sectors—like travel agencies, tour operators, and hotel management companies. Regulated in coordination with the Department of Culture and Tourism.

5. Media License

Designed for businesses in media, advertising, publishing, content creation, film, and digital marketing sectors. Available in media-focused zones like twofour54 and Dubai Media City.

E-commerce License

Enables businesses to sell goods or services online within the UAE and globally. Popular among online retailers and digital service providers.

How to Start a Business in Sharjah ?

Starting a business in Sharjah is a smart decision for entrepreneurs seeking growth in the Middle East. With Al Wahda’s expert assistance, the process becomes smooth and hassle-free.

- Choose Business Activity – Decide if commercial, professional, or industrial.

- Select Legal Structure – LLC, Sole Proprietorship, or Branch Office.

- Register Trade Name – Reserve a unique name with ADDED.

- Apply for Initial Approval – Get clearance to proceed with setup.

- Legal Documents – Prepare MOA, Articles of Association, and agreements.

- Lease Business Premises – Secure a compliant office space.

How Al Wahda Consultants Help You

Setting up a business in the UAE can seem complex—but not with Al Wahda by your side. We provide expert guidance and complete support at every step of your business setup journey. Here’s how we make it easy for you:

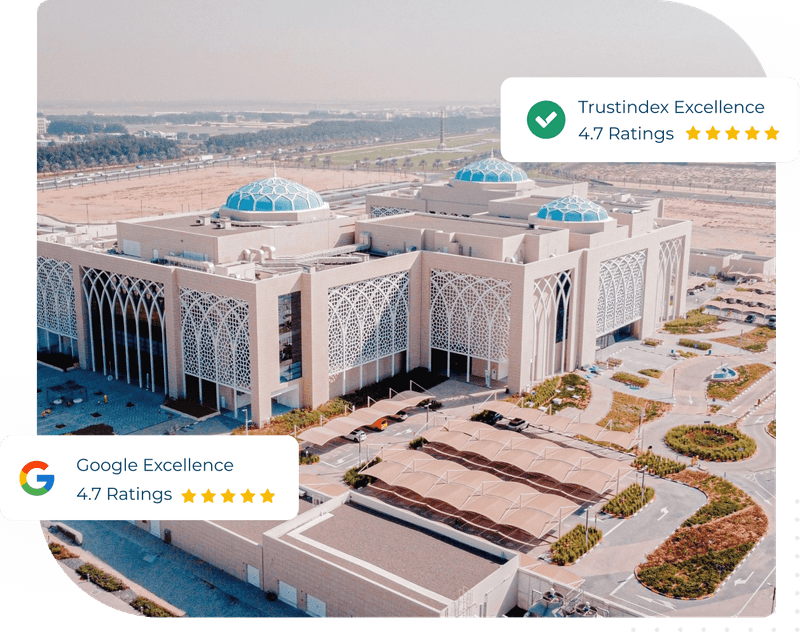

What our Customers Says

Trustindex verifies that the original source of the review is Google. Trustindex verifies that the original source of the review is Google. Exceptional service and a very professional team! The staff at Al Wahda Business Center are always friendly, helpful, and efficient. The facilities are clean, well-maintained, and perfectly equipped for business needs. Communication is smooth, and everything is handled with great attention to detail. Highly recommended for anyone looking for a reliable and professional business center in the area!Trustindex verifies that the original source of the review is Google. بكل أمانة، أعتبر مركز الوحدة للأعمال أفضل مركز تعاملت معه حتى الآن. يتميّز فريق العمل فيه بالاحترافية العالية والإخلاص في أداء المهام، وقد وجدت لديهم دعماً حقيقياً في كل خطوة من خطوات تأسيس مشروعي. أنصح بشدة كل من يرغب في بدء مشروعه التجاري في دولة الإمارات بأن يختار مركز الوحدة للأعمال، فهو ليس مجرد مركز أعمال، بل شريك موثوق يساعدك ويكون معك في كل خطوةTrustindex verifies that the original source of the review is Google. After working with several other companies, I can confidently say that Al Wahda Business Centre is the best I've experienced. I highly recommend them.Trustindex verifies that the original source of the review is Google. Very professional and peaceful atmosphere with all the necessities of an well established office.Trustindex verifies that the original source of the review is Google. Great service very professional helpful and frendly team .I'm really satisfied with the support they provided. Highly recommend this companyTrustindex verifies that the original source of the review is Google. Exceptional Business Support & Professional Environment Halaldays Tourism has been operating from Al Wahda Business Center since inseption, and we are extremely satisfied with the services and environment they provide. Located in the heart of Sharjah at Rolla – Burj 2000 (Damas Tower), the business center offers a highly strategic and accessible location for our operations. From private office space to reliable reception services and well-equipped meeting rooms, the infrastructure here is ideal for growing businesses like ours. The team at Al Wahda is professional, responsive, and always ready to support with tailored solutions — be it business setup, PRO services, accounting, or legal consultation. The flexibility in workspace options and the presence of value-added services under one roof make this business center a complete solution provider for any company looking to establish or expand in the UAE. Highly recommended for entrepreneurs, startups, and established businesses alike! Nahiyan Najeeb Founder & Director Halaldays Tourism Road to dreams & destinationsTrustindex verifies that the original source of the review is Google. One of the best business center in SharjahTrustindex verifies that the original source of the review is Google. 👍👍👍Trustindex verifies that the original source of the review is Google. Highly recommend them, good people with good work. Thank you Mr.Alam and Mr.Ahmed for the support during the entire registration process of our work space.Google rating score: 5.0 of 5, based on 25 reviews

Frequently Asked Questions

Sharjah Free Zones accommodate a wide range of industries including media, manufacturing, trading, logistics, consultancy, education, and IT services. Al Wahda helps match your business with the right zone and license.

Yes, all Sharjah Free Zones offer 100% foreign ownership with no need for a local sponsor or partner.

Company registration in Sharjah Free Zones is generally completed within 3 to 7 working days, depending on document readiness and license type.

Most Sharjah Free Zones do not require upfront paid-up capital, especially for service or consultancy licenses. However, it may vary depending on the business activity.

Yes, after incorporation, Al Wahda assists you with bank account opening in leading UAE banks with complete documentation support.

Ready to Strengthen your legal strategy? Let’s connect.

Let’s discuss how we can support your business.

Get in Touch!